Trump v. Vance

Argument: May 12, 2020

Petitioner Brief: Trump

Respondent Brief: Vance, et al.

Decision: TBA

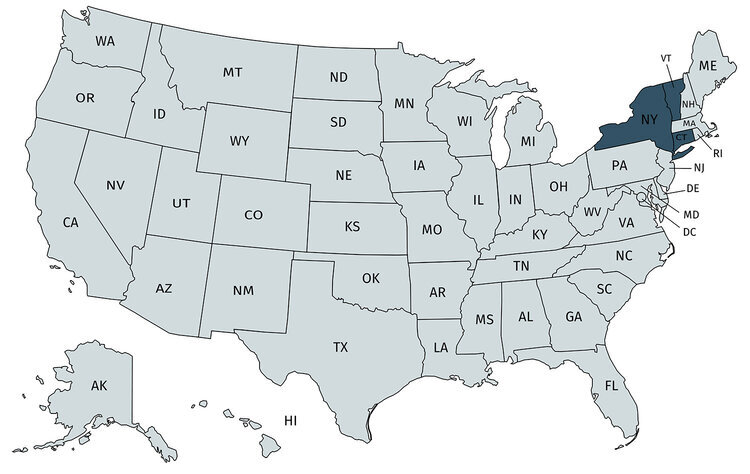

Court Below: Second Circuit Court of Appeals

Can the New York prosecutors get Trump’s financial information from Trump’s accounting firm?

On Tuesday morning, the Supreme Court will hear oral arguments about whether the President — and individuals and companies associated with him — are immune from state criminal investigation.

The New York grand jury subpoena

Public revelations about actions tied to Donald Trump caused the New York City District Attorney’s Office to open a grand jury investigation. The District Attorney sought to determine whether state law crimes had been committed in relation to efforts to silence porn star Stormy Daniels just before the 2016 Presidential election and to other behavior covered in testimony from Michael Cohen and others. Initially, the DA’s office (the DA is Cyrus Vance, Jr.) sent subpoenas to the Trump Organization, which cooperated for a time but balked at providing financial and tax records. In apparent response, new subpoenas were sent to Mazars USA LLP, the accounting firm for President Trump and for most if not all of the companies of which he is a direct or indirect owner. The subpoenas were very similar in form to subpoenas sent to the same accounting firm by Congressional committees and that are the subject of a separate case (LINK) before the Supreme Court. The records sought by the subpoena include years of financial and tax records of Donald Trump, Trump family members, and the many companies associated with them.

The subpoenas did not identify President Trump or any other person as the possible targets of the grand jury investigation.

Mazars indicated that it will comply with the subpoena if the federal courts do not invalidate it.

How did a state court subpoena end up in federal court?

The President’s lawyers filed suit in a New York federal court to challenge the subpoena, which relates to a state criminal proceeding. The suit asked the court to declare that the Constitution prohibits a state prosecutor from conducting a criminal investigation involving the President. Enforcement of the grand jury subpoena has been halted –stayed – throughout the proceedings, even though the President has lost at every level in the federal courts.

Rulings below

The President’s objections have been considered by both the United States District Court for the Southern District of New York and the United States Court of Appeals for the Second Circuit. That appellate court ruled against the President in December, and the Supreme Court agreed to hear the case and the related Trump v. Mazars. The hearing was originally scheduled for the end of March but was delayed for about six weeks because of the COVID19 pandemic.

Does the president have absolute immunity from state criminal investigations?

Even though the subpoena to Mazars does not identify the President as a target of the grand jury investigation, the President made a number of arguments to the effect that allowing a state criminal investigation of the President would violate both Article II of the Constitution (which vests executive power in the President) and the Supremacy Clause of the Constitution (which makes federal law the supreme law of the land).

The President’s arguments describe the impracticability of allowing thousands of local prosecutors across the country to initiate criminal investigations and prosecutions of the President, and the interference that kind of behavior would cause with the President’s ability to perform his duties.

The response of the District Attorney has been to point out that the grand jury proceedings are secret, do not yet involve indictment or prosecution of the President, and are not necessarily directed at the President but may involve other individuals and companies to whom or which any Presidential immunity does not apply. The District Attorney has contended that the President does not have the level of immunity he claims, especially as to claims that have nothing to do with conduct of the President and others before becoming President. Moreover, both the District Attorney and the lower courts rejected the claim that responding to the subpoena would impair the President’s ability to perform his duties, noting that the subpoena is directed to an accounting firm. A request to a third party does not require any effort by the President to comply. Furthermore, every recent President has made substantial personal financial disclosures without impairment of their ability to function.

If there is Presidential immunity, can it prevent an investigation into possible criminal behavior by persons not the President?

The scope of immunity asserted by the President is breathtaking because it encompasses not only his own behavior, but also that of any other person, if investigating the conduct would “involve” the President. In effect, the President claims that he can confer immunity – potentially extending beyond the expiration of a statute of limitations – on any business colleague, employee, or affiliated company.

Unsurprisingly, neither the District Attorney not the lower courts have felt it necessary to devote substantial effort to refuting this line of argument.

Amicus argument: Most of the subpoenaed documents do not even belong to the President

In amicus curiae (“friend of the court”) briefs before the Court in Vance and Mazars, my colleague Sean Kealy and I present an argument ignored by the parties in the cases. We argue that President Trump cannot object to his accounting firm or banks turning over financial and tax information that actually does not belong to him. The information actually belongs to the more than 500 separate business entities connected to the Trump Organization.

President Trump argues that the records of these companies are “his” records, and that the company tax returns are also “his.” However, the reason business owners form corporations and LLCs is to make sure they have liability protection by setting up separate legal persons – the companies – that insulate the individual owner from liability when something goes wrong. These companies are legally separate from their owners, and for decades, the President has steadfastly asserted this separateness in a variety of legal contexts. Under state law, records such as those covered by the subpoena belong only to the company, and so the President has no right to claim the companies should be protected from a subpoena because Trump doesn’t have an ownership interest at all in their content.

CONTRIBUTOR

Jim Wheaton is a Clinical Associate Professor at Boston University School of Law, where he also directs the Startup Law Clinic. He is a former chair of the LLCs, Partnerships & Unincorporated Entities Committee of the American Bar Association Section of Business Law, and an expert witness on business entity issues. Earlier in his career, he clerked for a judge of the U.S. Court of Appeals for the Fourth Circuit.

Recent Reports:

fromSubscript Law Blog | Subscript Lawhttps://https://ift.tt/2AmpHa5

Subscript Law

4 Curtis Terrace Montclair

NJ 07042

(201) 840-8182

https://ift.tt/2oX7jPi

Comments

Post a Comment